New and used plug-in electric vehicles and fuel cell vehicles qualify for a federal income tax credit of up to $7,500 that is in place until 2032, thanks to the Inflation Reduction Act (IRA). Both you and the vehicle must meet certain requirements in order to qualify for this Clean Vehicle Credit, and those requirements differ for new vs used vehicles. Consumers must purchase or lease a new or used EV through an IRS registered dealer in order to receive the tax credit at point of sale or at tax time.

For New Electric Vehicles

Consumer Requirements

As of 2023, there are now income caps to qualify for the Clean Vehicle Credit. The below are the modified adjusted gross income (AGI) limits:

- Joint filers must have an income of $300,000 or less.

- Heads of household must have an income of $225,000 or less.

- Individual filers must have an income of $150,000 or less.

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your AGI is below the threshold in one of the two years, you can claim the credit.

There is no limitation on the number of vehicles a person can purchase and receive credits for in a particular year, provided the person and vehicles meet all of the other eligibility requirements (although consumers are limited to two credit transfers to a dealer per year, per social security number).

Vehicle Requirements

To qualify for the federal tax credit, a vehicle must meet three requirements:

- Its final assembly location must be within North America;

- Its Manufacturers Suggested Retail Price (MSRP) must be under a certain limit;

- It must meet one or both of two complicated sets of battery requirements.

We’ll go into each of these in more detail.

Please note, not every version of a vehicle model that is eligible for the federal tax credit will necessarily qualify. Check with the dealer/seller to determine the eligibility of your specific vehicle.

Final Assembly Location

To qualify for the federal tax credit, the vehicle’s final assembly location must be within North America. If the vehicle is assembled outside of North America, it is irrelevant whether it meets the other sets of requirements; it does not qualify.

Price Cap

To qualify for the federal tax credit, a vehicle may not exceed the MSRP cap of vehicles in its class. For sedans and hatchbacks, this limit is $55,000; for SUVs, pick up trucks, and vans, the limit is $80,000. To be clear, if you are looking for a sedan and it has an MSRP of $52,000, but the dealer sells you the car for $57,000, you still qualify for the federal tax credit because it's based on MSRP, not final purchase price.

Similarly to the final assembly location, if the vehicle does not meet the price cap requirement, it is irrelevant whether it meets the other sets of requirements; it does not qualify.

Battery Requirements

The IRA includes two new battery requirements that vehicles must meet: one for critical minerals and one for battery components. Each requirement is worth $3,750; so if, in addition to meeting the final assembly location and MSRP cap requirements, a vehicle meets both battery requirements, it qualifies for $7,500. But if it only meets one of the two battery requirements (in addition to final assembly location and MSRP cap), it only qualifies for $3,750. And if it meets neither battery requirement, it does not qualify for a tax credit, regardless of its assembly location or MSRP.

As a consumer, you do not need to know or memorize these battery components. You can simply visit Drive Green's EV Finder to see what qualifies for what. But if you’re interested in the details, here they are:

The new battery requirements fall into two buckets: critical minerals and battery components.

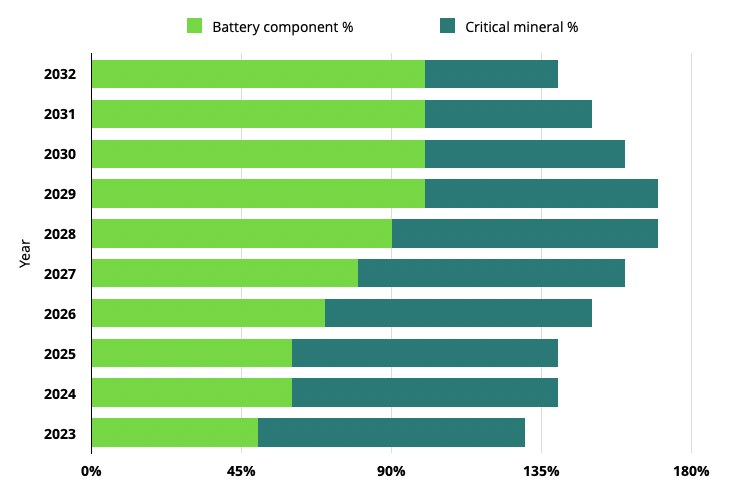

- Critical Minerals: Starting 2023, 40% of the battery's minerals (by value) must be mined OR processed in North America, or a country with a free trade agreement with the US or recycled in the US. This percentage will ramp up over time (see table below).

Battery Components: Starting 2023, 50% of the value of battery components must be manufactured OR assembled in North America. This percentage will also ramp up over time, see table below.

In addition, there is another battery sourcing provision: the "foreign entities of concern" component. Starting in 2024, to qualify for the federal tax credit, vehicles cannot have any battery components from a foreign entity of concern (i.e. Russia and China). Starting in 2025, batteries cannot have any critical minerals from a foreign entity of concern to qualify.

Leasing Loophole

If your vehicle of choice does not qualify for the Clean Vehicle Credit, you may want to consider leasing. The IRA set up the Commercial Vehicle Tax Credit that does not have all the complicated requirements of the Clean Vehicle Credit for individuals. That means that a manufacturer can sell a vehicle to its leasing arm, which can then take advantage of the federal tax credit. Many are deciding to pass on the savings to consumers in the form of lower monthly payments.

How to receive the tax credit

As of January 1, 2024, consumers of new and used electric vehicles have the option to receive the tax credit either as part of their tax return or at point of sale. No matter which option is chosen, consumers must purchase or lease their new or used electric vehicle from an IRS registered dealership. Unfortunately, there is no list of IRS dealerships that we know of, so you will have to verify with the dealership you have chosen to purchase/lease from.

Tax Returns

If you opt to receive the tax credit as part of your tax return, you will have to fill out IRS form 8936 when filing your taxes. This option also means that the tax credit is limited by your personal tax liability.

Point of Sale

If you opt to receive the tax credit at point of sale, you can choose to receive cash to go towards the downpayment or apply the credit towards the cost of the EV. This means the tax credit is no longer dependent upon your personal tax liability (but personal income limits still apply), instead you can transfer the tax credit to an IRS registered dealership.

Steps to Make Sure You Secure the Tax Credit

When purchasing/leasing an EV, familiarize yourself with these steps before you go to the dealership:

- Call to make sure the dealership is an IRS registered dealership.

- The dealership must submit a "time of sale report" containing the buyer and vehicle information to the IRS Energy Credits Online portal to determine vehicle eligibility.

- Without the above submission, buyers cannot claim a tax credit at either point of sale or through their tax returns.

- The dealer must provide the buyer with a copy of the IRS' approval of the dealership's submission on the Energy Credits Online portal.

- The above must be completed at time of sale, or the buyer will not receive the incentive.

So Where Do I Start?

The list of vehicles that qualify for the federal tax credit is ever-changing as battery requirements ramp up, manufacturers shift their supply chains, and new vehicles come on the market. We keep our Drive Green shopping tool up-to-date so you just have to look one place to find out which vehicles qualify for what federal (and state!) incentives.

For Used Electric Vehicles

Starting in 2023, used electric vehicles qualify for the federal tax credit for the first time! Here are the fast facts prospective buyers need to know.

- There are no battery sourcing requirements for used vehicles.

- Buyers can expect a tax credit of $4,000 or 30% of sales price, whichever is lower.

- The car must be bought from a dealership and be at least 2 years old.

- The cost of the car cannot exceed $25,000.

- The used car tax credit can only be on the first resale of a vehicle.

- The income threshold to qualify is $150,000 for joint filers and $75,000 for a single filer.

- Buyers can only use this credit once every 3 years, but two individuals filing a Married Filing Joint tax return could both claim the credit in a particular tax year.

- Review the "how to receive the tax credit" section under the new EV requirements above.